The OMXC20 index had a mixed performance in 2022, due to factors such as the ongoing COVID-19 pandemic and uncertainty around global economic conditions. However, despite this volatility, our portfolio “Dania” continued to perform well throughout the year.

In fact, we attribute our success in part to the advanced AI and math algorithms that we use to analyze market data and identify opportunities for investment. In 2022, we further improved our algorithms and adopted a smarter approach to moving to cash instead of being fully invested, which resulted in even higher returns and lower risk for our investors.

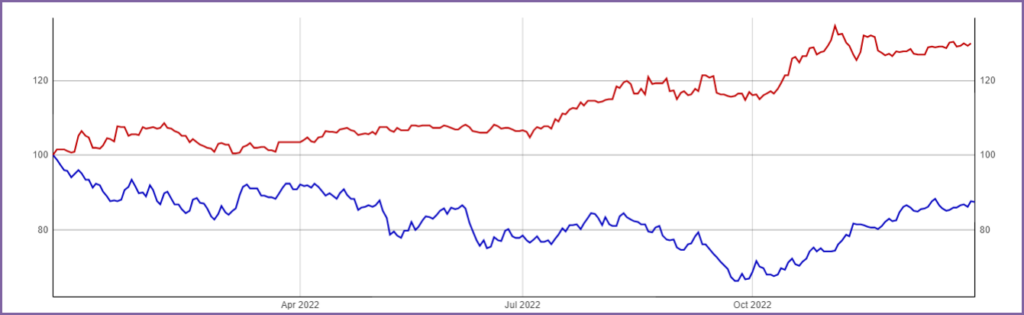

We are proud to report that the Dania portfolio had a remarkable compound annual growth rate (CAGR) of 21.24% and yearly volatility of 12.53%. This impressive performance highlights the power of advanced analytics and the benefits of a more focused investment strategy.

In contrast, the benchmark ETF Eden had a negative CAGR of -12.76% and a yearly volatility of 30.41%. This stark difference in performance underscores the importance of investing in a well-managed portfolio with advanced technology and smart investment strategies.

APR

2022

About the Author: