SustainableUSA is a “green” portfolio which only invests in companies which scores high in sustainable, environmental, social, and corporate governance (ESG) values.

It is a “feel good” portfolio which yields a high return while maintaining low risk and supporting a sustainable future.

This portfolio is provided to the investor community for free and is updated with new weights at beginning of every month.(You can be notified by email) The initial amount to establish the portfolio is USD 20.000. It probably can be made with a lower amount, but consider your transaction costs.

Performance

Compounded return since inception: 20,64% (Index: 10,29)

Compounded return this year: 23,54% (Index: 1,21)

Sharpe: 1,16%

Volatility: 17,77 (Index: 12,45)

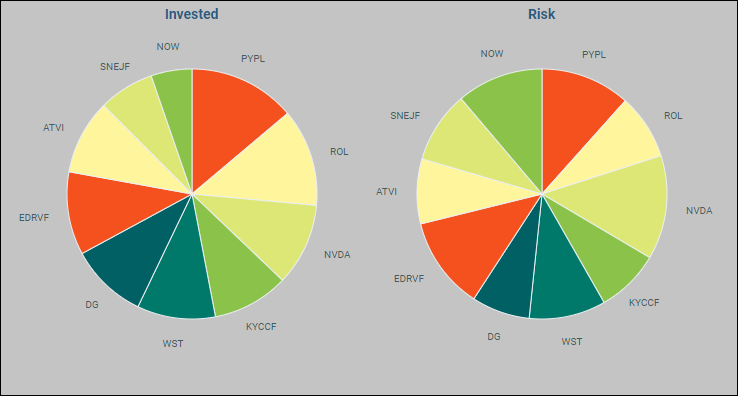

Current composition as Nov. 1 2020

Principles

The graph above shows the our approach applied to the portfolio. It based on AI algorithms and our take on classic portfolio theory. These are applied especially to the composition process and rebalancing logic.

While this portfolio is traded in in real life at Interactive Brokers, the graph also shows simulated data back from 2010 with the same principles applied.

SoftCapital serves financial institutions with optimal fund designs and rebalancing of same, but as a service for retail users we provide the recipe of this portfolio and post all rebalancing recipes as they happen on this blog.

Next rebalancing

This portfolio has a monthly rebalancing schedule. At Dec 1. 2020 rebalancing and intermediary results will be published as a comment to this blog. Send an email to: “susa at softcapital.com” to receive the rebalancing recipe every month.

Intended audience / Investors

This portfolio composition and rebalancing recipes are meant for the private investor (retail) as a free service from SoftCapital. It is a subset of an institutional grade portfolio.

Amongst other, it differs in that an institutional grade portfolio has more components in the portfolio and the rebalancing principles are a bit more detailed and frequent.

Disclaimer

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this blog (article), will be profitable, equal any corresponding indicated historical performance level(s),or be suitable for your portfolio.

OCT

2020

About the Author: