Have you ever in the middle of your pudding stopped mid-pudding to wonder how it might have some “proof” in it, as suggested by the expression “the proof is in the pudding“? We found out the hard way during the corona period in many Teams and Zoom meetings that this idiom was highly relevant to what we were doing. While demonstrating our tools for portfolio construction and -rebalancing we experienced growing scepticism as we during presentation reach the result part in the form of a performance graph over time and some hard statistics.

“-This cannot be true” or “-this is a backtest right?”

So to overcome the backtest issue, and truth be told – there is a lot of dubious backtests out there – we started to eat our own dogfood and created and invest in 4 portfolios ourselves, using Optimizer, and while we enjoy using our cash on development of new and better tools, we felt it was a necessity for documentation purposes

This was a good decision, they perform great with high return and low risk, and this is the most important point when designing a new fund.

We are happy – they are now contributing to the company and we have proof of performance to show to prospective partners during negotiations.

Currently we are running 4 funds:

- SoftCapital ESGWorld acc.

- SoftCapital USTech acc.

- SoftCapital Global Health acc.

- SoftCapital SP-500

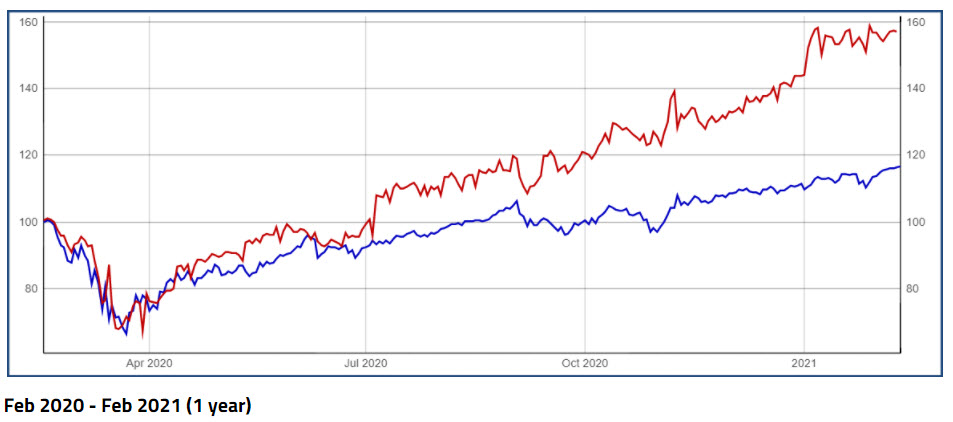

Above, the performance graph of SoftCapital ESGWorld, which invests in issuers that are suitable from a financial perspective and whose activities are consistent with certain environmental, social and governance (“ESG”) or Impact criteria.

History of this traded portfolio is growing on a daily basis and factsheets, statistics and more available upon request. We are a software company not a fund or investment company so this is closed portfolio.

MAR

2021

About the Author: