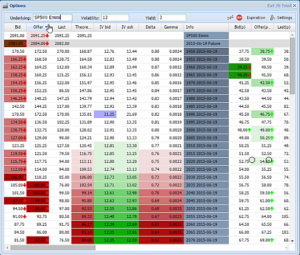

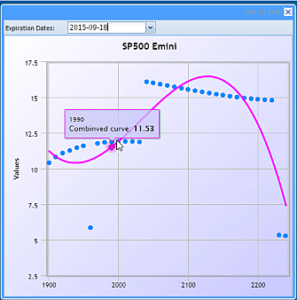

Derivative calculator

The ability to calculate – and especially calculate very fast is an essential part of TOP. Several instruments like options and futures, has no meaning unless value are added in form of calculated numbers that give meaning and find the opportunities. TOP contains all the relevant formulas needed to calculate the correct theoretical price of a given financial instrument.